Second Quarter 2021 Benchmark Results for Mystery Shops and Resident Surveys Executive Summary

Since 1984, Ellis, Partners in Management Solutions has specialized in helping our customers achieve their business goals. We are pleased to offer a turn-key integrated customer experience program, backed by our outstanding customer service, cutting-edge technology, and longstanding ethical business practices. Our apartment mystery shops, resident surveys, live training, and e-learning partner (Edge2Learn) are resources that can be used together or independently to address specific needs or jointly for ongoing employee performance optimization. Our goal is to help you achieve yours.

As companies reflect on the many lessons learned in 2020, new ways of navigating customers through the leasing process are being tested – online communication channels (chat, text, booking online, etc.), internet and telephone experiences and virtual, guided, and self-guided tours. Which approach will result in the best customer experience? Which leasing strategy will result in the highest conversion rate? Sales are made and lost based on the overall customer experience. So, what are the barriers to conversion? We believe the answers to these questions and resulting trends can be found within the leasing data. We use data to reveal patterns and trends which help us to improve leasing performance. Data patterns help us to identify areas of strength and areas which need more attention. Only clean, unmanipulated data can provide the evidence we need to help inform better decision making around industry goals and strategies.

Join us at the end of this letter as we continue our 2021 theme, “Barriers to Lease Conversion”, and turn our focus to evaluating the customer experience based on the website, internet, and telephone shops using clean data from 2020 and 2021.

ELLIS’ SECOND QUARTER 2021 BENCHMARK: OVERALL RESULTS

Mystery Shops

Ellis benchmarks apartment mystery shop performance on the 10 key Benchmark questions and the Customer Experience. Companies can qualify for platinum, gold, silver, or bronze level based on their company’s overall Benchmark score for the quarter.

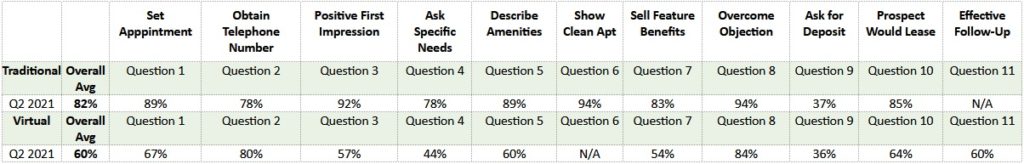

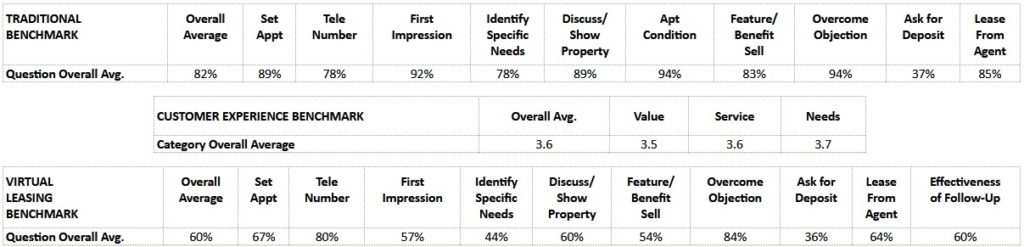

In 2020, the overall average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops1 was 84%, representing 18,645 shops. First Quarter 2021 decreased marginally to 83%, and the average dropped again to 82% for Second Quarter 2021, representing 4,589 shops. In response to industry needs during the pandemic and customer demands, we introduced the Ellis Virtual Shopping Benchmark in Q2 2020 based on nearly identical 10 key Benchmark questions. In 2020, we conducted 10,220 virtual shops and the average score was 58%. During First Quarter 2021 the Ellis Virtual Shopping Benchmark improved to 63% but Second Quarter 2021 reflects a decrease to 60%, which remains higher than last year’s average. The Ellis Customer Experience Benchmark score remained steady at 3.6 for the Second Quarter 2021.

As we compare similar questions on Ellis Traditional Multifamily Industry Benchmark to the Ellis Virtual Leasing Benchmark scores, we can see the areas which are more consistent in delivery and areas that can be improved.

Mystery Shops Overall Average Performance

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING MYSTERY SHOPPING COMPANIES FIRST AND SECOND Quarter 2021

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING MYSTERY SHOPPING COMPANIES FIRST AND SECOND Quarter 2021

Ellis wishes to congratulate the companies below for their Ellis Shopping Benchmark performance for the past two calendar quarters.

Second Quarter 2021

Tier 1 (70 or more completed shops)

Ellis Traditional Benchmark Platinum Level Achievers

- None

Ellis Customer Experience Benchmark Gold Level Achievers

- RangeWater

Tier 2 (30 – 69 completed shops)

Ellis Traditional Benchmark Platinum Level Achievers

- None

Ellis Customer Experience Benchmark Gold Level Achievers

- IMT Residential

- Wood Partners

First Quarter 2021

Tier 1 (70 or more completed shops)

Ellis Traditional Benchmark Platinum Level Achievers

- None

Ellis Customer Experience Benchmark Gold Level Achievers

- American Landmark

Tier 2 (30 – 69 completed shops)

Ellis Traditional Benchmark Platinum Level Achievers

- IMT Residential

Ellis Customer Experience Benchmark Gold Level Achievers

- Holland Residential

- IMT Residential

- Morgan Group

- Coastal Ridge Real Estate

- RangeWater

- The Hanover Company

Companies are listed in alphabetical order

Resident Surveys

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Surveys Program. It evaluates performance on 5 key touchpoints of the prospect and resident journey. The percentage of surveys responded to by the onsite team and the average number of days it took for the team to respond are also measured because these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies the ability to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

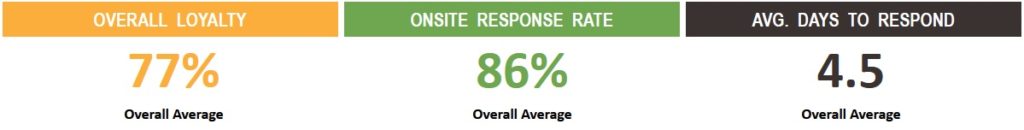

The overall average Ellis Loyalty Benchmark score in 2020 was 76%, and it increased slightly to 77% for Second Quarter 2021. In 2020, the onsite response rate averaged 89% while dipping down to an average response rate of 86% during Second Quarter 2021. The average response time was 4.5 days in Second Quarter 2021 as compared to 5.3 days in overall 2020.

Note: Ellis is not publishing Resident Surveys Top Performing Companies for First Quarter 2021.

Resident Surveys Overall Average Performance

Ellis’ customer loyalty score is based on a scale of 0%-100% (see chart below):

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING RESIDENT SURVEYS COMPANIES FIRST and SECOND Quarter 2021

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING RESIDENT SURVEYS COMPANIES FIRST and SECOND Quarter 2021

Ellis wishes to congratulate the companies below for their Ellis Surveys Benchmark performance for the past two calendar quarters.

Second Quarter 2021

Ellis Best in Class Achievers

Tier 1 (1,600 or more units)

- Affinity Property Management

- Block Multifamily Group, LLC

- Cathcart Property Management

- F and F Realty

- Fore Property Company

- FPI Management

- Guardian Management, LLC

- Lincoln Property Company

- LMC, a Lennar Company

- Mack Property Management, LP

- Manco Abbott

- MG Properties Group

- Olympus Property

- R & V Management LP

- Russo Development

- Simpson Property Group

- Sparrow Partners

- TriBridge Residential

- Woodmont Properties

Ellis Best in Class Achievers

Tier 2 (1,599 or fewer units)

- CLMS Management

- Evolve Management Group, LLC

- GDC Properties, Inc.

- Ghertner & Company

- Landmark Communities

- Longboat Enterprises

- ResideBPG

- Reybold Venture Group

- Samuels & Associates

- StarPoint Properties

- Sunrise Management & Consulting

- United Financial Group, Inc

First Quarter 2021

Ellis Best in Class Achievers

Tier 1 (1,600 or more units)

- Affinity Property Management

- Block Multifamily Group, LLC

- Capstone Real Estate

- F and F Realty

- Fore Property Company

- FPI Management

- Friedman Realty Group

- Guardian Management, LLC

- Lincoln Property Company

- LMC, a Lennar Company

- Manco Abbott

- MG Properties Group

- Olympus Property

- Prime Companies

- R & V Management LP

- Simpson Property Group

- Sparrow Partners

- TriBridge Residential

- Woodmont Properties

Ellis Best in Class Achievers

Tier 2 (1,599 or fewer units)

- CLMS Management

- Dolben

- Evolve Management Group, LLC

- GDC Properties, Inc.

- Ghertner & Company

- Longboat Enterprises

- Mountain States Property Management

- ResideBPG

- Reybold Venture Group

- Samuels & Associates

- Stockbridge Capital Group

- Sunrise Management & Consulting

- TM Realty Services

- United Financial Group, Inc

Companies are listed in alphabetical order

ELLIS’ SECOND QUARTER 2021 BENCHMARK: QUESTION/TOUCHPOINT

RESULTS

Mystery Shops

How did we do?

The charts below reflect the average score of Ellis’ entire database for each of the 10 key benchmark questions and the Customer Experience by category, as well as the combined overall Benchmark scores for Second Quarter 2021. This data provides a roadmap to success, which in most cases means returning to the basics of sales and customer service.

Resident Surveys

How did we do?

The chart below reflects the average scores across all Ellis Resident Survey companies for each survey touch point for Second Quarter 2021, as well as the combined overall loyalty score and average accountability performance results.

BARRIERS TO LEASE CONVERSION: INITIAL CONTACT – WHEN DOES IT BEGIN?

BARRIERS TO LEASE CONVERSION: INITIAL CONTACT – WHEN DOES IT BEGIN?

The traditional leasing office functions have been upended by increased expectations from empowered “connected customers”. Who knew that there would come a day when the customer could bypass the telephone and strictly communicate in a virtual manner until the day of move-in? More and more customers are choosing to make first contact in a variety of ways and even sometimes a combination of contact points – internet, telephone, and/or the property website (i.e., chat, text, contact us). This trend not only applies in multifamily but across many industries. Additionally, the customer expects their experience with the product to follow them wherever they go. But offering a seamless integration between live service and self-service, can be a difficult task for companies. Companies are utilizing unmanipulated customer data points as the beginning step to move from a typical reactionary role response to anticipating customer needs and concerns. Nothing is unimportant when it comes to customer data. Clean data allows companies to put a close lens on the different aspects of the initial customer experience which provides increased opportunities to remove barriers to lease conversion.

Data has no value if it lacks a purpose, so a strategy must accompany it. In his recent blog post “I Don’t Want to Play”, Seth Godin, an American author and business executive, explains that if we desire to improve performance, then we must have a strategic approach and know our goals. Without a purpose and strategy, we find ourselves in a reactive mode, which Godin compares to innings in a game – new inning, new response. Yet, if we allow tactical approaches to control our destiny then we undermine useful strategies. According to Godin, tactical thinking says, “Here’s a situation, what’s your best reaction/response,” while the strategic approach questions the tactical approach by asking, “Does playing this particular tactical game get me closer to the reason I’m here in the first place?” Balancing your clean data with both strategy and tactics should be the goal.

As you begin to look at your data, there must be a standard – the same set of rules applied – for it to be credible and actionable. In this letter, we compare industry-wide internet and telephone shopping report data from 2020 and 2021 as well as sharing highlights from customer experiences on property websites. This additional information gives us the opportunity to dig deeper by asking more detailed and revealing questions.

1. Website Experiences

Property websites have always been an important component in the customer’s journey, but COVID has forced the industry to offer additional options in today’s environment of the empowered connected customer. Customers are consuming high volumes of information in their search for apartment homes and making the process easy to “vet” an apartment is essential. For example, let’s consider how customers schedule appointments today. While many customers will set up an appointment by telephone, often it is difficult to reach a live leasing professional on the first attempt. Hence, we recognize the shift to customers scheduling a tour directly on the website via chat, text, booking online, contact us form, etc. That said, what does the experience on the website look like today? Is it easy and effective? Do your customers want to lease right then and there or are they excited to pursue an appointment and tour the community? Think about the method behind the madness in this context:

- First Impressions. Is the first impression of the website a positive, neutral, or negative experience?

- Information Portrayal. How is the lifestyle conveyed in terms of photos, floor plans, 3D/virtual tours, amenity and neighborhood descriptions and reviews on the website? Is information easily found on rents/concessions, availability, scheduling a tour, etc.?

- Functionality. Is the website easy, intuitive, and understandable? Is the website void of technical issues?

- Interaction. What does the overall interaction look/feel like via human and/or technology? Is that interaction prompt, personalized, and communicative?

- Follow-Up. Are the next steps for the customers clearly communicated? Is the follow-up timely and personalized?

Although Ellis’ research is preliminary on how the website experience translates into a tour, we can share some high-level observations and lessons learned from website experiences:

- Property websites are a great resource for customers to learn about the community if organized and concise. Overwhelming the customer with information overload (i.e., verbose, multiple pop-ups, required contact information to gain information) may result in a high bounce rate.

- Showcasing the lifestyle of living at the community allows the customers to get a sense if they can call this community home. Photos, videos, floor plans, descriptions, etc. tell a story – good, bad, or indifferent. What website story does your community tell?

- Booking online is the quickest/easiest way to schedule an appointment. Scheduling an appointment via chat or text can be cumbersome and a lengthy process. A 3-hour chat or text conversation to schedule an appointment is too long. Understand customer expectations and how all communication channels are impacting the customer’s experience.

- Integrations between the website technology and the CRM are key for customers booking appointments online. Arriving at a property and learning that your appointment is not in the CRM, and you must rebook can be off-putting to a customer.

- Regardless of how the customer chooses to interact with your community website, ensuring the experience feels human-like can go a long way in the eyes of the customer. Technology or not, a personalized and responsive interaction can make a difference.

- An effective follow-up strategy, prior to the customer’s visit, can be delivered by email, text, telephone, or a combination of efforts as long as it is personalized, not generic. Communicating the right message at the right time can make a difference.

Remember, the website experience may be the customer’s first initial outreach to your community. Ensuring this experience is an informative, seamless and hassle-free experience helps to advance the conversation to the next level.

What will your strategy be? What tactics will you use?

2. Internet Experiences

Customers contacting the property through an ILS, review site and/or property website is another critical customer touchpoint. In most cases, the customer is reaching out for more information. Perhaps, they cannot find the information they need on the website, or they have specific questions. Do your customers receive a personalized and professional response in a timely manner? Are you addressing the customer’s questions? From a customer’s perspective, what does this customer touch point look like?

In review of Ellis’ internet shopping report data collected in 2020 and 2021, we looked at 6 key areas which can positively or negatively impact a customer’s experience and willingness to lease. The results are outlined below:

Response time is and always has been one of the core attributes of customer service, and the first response is the most critical. In a Harvard Business Reviews study, out of 2,241 U.S. companies they measured, 24% took more than 24 hours to respond to the lead, with 23% never responding at all. How can a quick response time positively impact lease conversion?

- You have a higher chance of catching the customer by their computer or phone.

- Their research is fresh, and you are still on their mind.

- You will have a competitive advantage over competitors.

- The customer will associate a quick response with the service they will receive as a resident.

You are on the clock! Studies show that internet customers who receive a response within 10 minutes, are 3X more likely to visit. Not answering an internet lead in a timely manner is equivalent to calling the property and never reaching a live leasing professional.

Once contact is made, the ability to adequately address questions through an internet inquiry can be challenging, too. Gaps in the time between responses, can cause customers to drop off and move on to the next community. The ability to keep the connection, and adequately answer a customer’s questions, will directly impact their desire to advance the conversation.

Using the data above along with individual community data can reveal patterns and trends which can be used to improve performance. This process takes some focus and time, but the results are invaluable. At the end of the day, you cannot manage what you do not measure, and you cannot expect what you do not inspect.

When was the last time you personally walked through the entire online customer journey using all the tools made available to your customers? What does that experience look like? Does the experience match the data points shared above?

What will your strategy be? What tactics will you use?

3. Telephone Experiences

Surprisingly, 52% of today’s customers still prefer to speak to a live person and resolve issues over the telephone. Typing a lot of information or questions on a screen can be exhausting for some people, and many customers prefer the telephone over the internet because of these reasons and more. Many customers still value a personal connection especially when it comes to finding a home. Unlike an internet lead, the telephone call is difficult to ignore. Will this change in the future? Perhaps but for now, we need to address those customers who prefer to communicate by telephone.

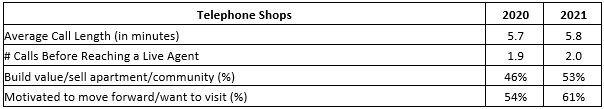

How do the telephone experiences for your customers compare to almost 11,000 Ellis’ telephone shops collected during 2020 and 2021? Can the customer reach a live leasing professional without having to make multiple calls? What information is being identified and shared with the customer? Is the telephone conversation representative of time well spent?

Today’s customer experience on the telephone is a maddening mess of navigation, listening to awful on-hold music, talking to robots, and repeating yourself over and over again. “Please hold, your call is important to us” are eight irritating words customers are fed up with. Americans spend millions of hours each year on hold, pacing around, and desperately hoping not to be disconnected. Understandably, when they reach a live person, they are ready to engage with someone who is willing to take as much time as they need to answer their questions.

Leasing professionals can increase their conversion rate from the telephone to an in-person visit by building value.

- Focus on outcomes. What will their life look like when they choose to live at your community? Where will they shop, eat, socialize, etc.?

- Help vs. sell. What wants and needs do they have? How can your community meet each one of them?

- Solve their problem. Utilizing open-ended inquisitive questions will reveal the problem they need solved.

- Understand that value is not always logical. It is important to identify what is truly valuable to the customer. Ask relevant questions which lead the conversation towards them choosing to visit the community.

Making telephone calls a priority in the leasing office is key. If leasing teams can reduce the number of attempts it takes for a customer to make contact on the telephone and build value during the conversation, it will result in a customer who is more motivated to visit the community which is the ultimate goal of the telephone call.

A positive first impression is an important start to building the relationship with customers. Whether that interaction is on the

internet, telephone, and/or the property website (i.e., chat, text, contact us), the initial contact impression will set the tone for the entire customer experience. By using data, companies can pinpoint areas which need more attention, develop a strategy, and apply tactics to move them toward their goal.

Data has no value if it lacks a purpose. What is your data telling you? How will you answer?

Thank you for your ongoing support, participation, and feedback, which help make this report informative, fresh, and a reliable resource. We hope you will find Ellis Partners in Management Solutions to be not only the finest source for apartment mystery shopping and resident surveys but also a training resource (including our partner (Edge2Learn) for your organization. Additional support and information can be found on our website. Also, Edge2Learn’s free multifamily training resource library includes several leasing training resources for you and your teams.

July 30, 2021

Prepared by Joanna Ellis, Chief Executive Officer and Francis Chow, Chief Strategic Officer