Second Quarter 2017 Benchmark Results for Mystery Shops and Resident Surveys Executive Summary

Ellis, Partners in Management Solutions specializes in helping the multifamily industry achieve their business goals by optimizing the customer experience at key touch points from initial visit to move-out through our Apartment Mystery Shops, Resident Surveys, and Training solutions. Our mystery shops, resident surveys, and training are resources that can be used either independently to address specific needs or together as a turnkey program for ongoing performance optimization. We believe the more you know about your customers and what they have to say about you, the better you can respond to their needs. The better your employees know how to respond, the more successful you will be at developing loyal customers who pay more, stay longer and refer friends and family.

As we approach the year 2020, the ability to give external customers what they really need and want will depend on how well leaders do the same for their internal customers, specifically the Millennials. This generation of employees is trending to comprise more than one in three adult Americans by 2020 and 75 percent of the workforce by 2025. Our letter series this year, “Millennials: Identifying Missing Pieces in the Workplace“, will focus on four core areas: basic need, contribution, feeling of belonging, and personal growth. This quarter we explore their desire to contribute and grow in the workplace and how feedback is necessary to increase engagement and improve loyalty.

We thank you for joining us each quarter as we convey combined Benchmark results and sales trends, and offer practical improvement ideas.

Second Quarter 2017 Benchmark: Overall Results

Mystery Shops

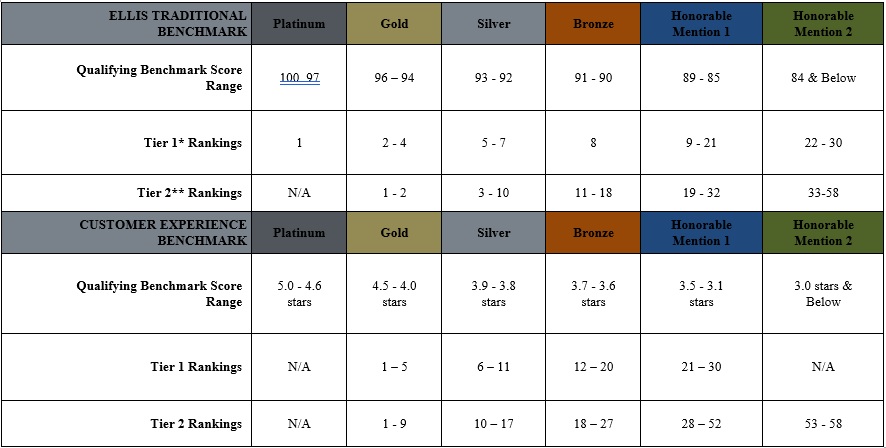

Ellis benchmarks mystery shop performance on the 10 key Benchmark questions and the Customer Experience. Companies can qualify for platinum, gold, silver, or bronze level based on their company’s overall Benchmark score for the quarter.

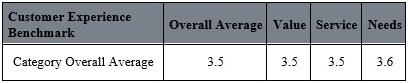

In 2016, the overall average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops1 was 85%, representing 41,894 shops, and remains 85% in the Second Quarter 2017, representing 11,283 shops. In 2016, the overall average Ellis Customer Experience Benchmark score was 3.5, with no variance from that average for the Second Quarter 2017.

* Tier 1 = 70 or more shops

** Tier 2 = 30-69 shops

Resident Surveys

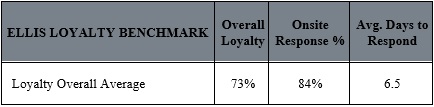

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Survey Program. It evaluates performance on 5 key touchpoints (lead conversion, move-in, maintenance, renewal, move-out) of the prospect and resident journey. The percentage of surveys responded to by the onsite team and the average number of days it took the team to respond are also measured, as these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies the ability to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

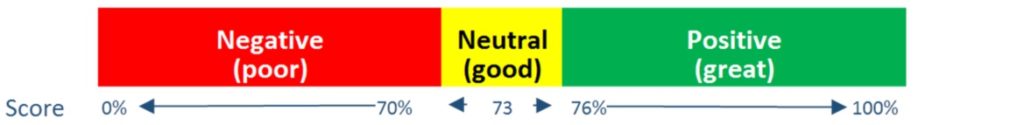

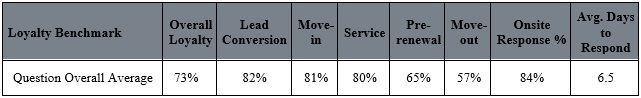

Effective First Quarter of 2017, Ellis changed the loyalty score to a scale of 0%–100% from a scale of -100%–100%. The change in scale is reflected in the scores for this quarter (see chart below):

The overall average Ellis Loyalty Benchmark in 2016 was 73%; the score held at 73% for Second Quarter 2017. In 2016, the onsite response rate averaged 78%; Second Quarter 2017 reflects an increase to 84%. Teams took an average of 6.5 days to respond in Second Quarter 2017 versus an average of 7.8 days in 2016.

CONGRATULATIONS TO ELLIS BENCHMARK’S TOP PERFORMING COMPANIES SECOND QUARTER 2017

Mystery Shops

Ellis Traditional Benchmark Platinum Level Achievers

Tier 1 (70 or more completed shops)

- Gables Residential

Ellis Customer Experience Benchmark Gold Level Achievers

Tier 1 (70 or more completed shops)

- Amli Residential

- CWS Apartment Homes, LLC

- Gables Residential Services

- Mid-America Apartment Communities

- Windsor Property Management Co/GID

Tier 2 (30 – 69 completed shops)

- IMT Residential

- JVM Realty Corporation

- LMC, a Lennar Company

- Matrix Residential

- Mill Creek Residential Trust

- Preferred Apartment Communities

- Red Peak Properties

- Richman Property Services, Inc.

- The Carlyle Group

Resident Surveys

Ellis Best in Class Achievers

Tier 1 (1600 or more surveys received)

- CWS Apartment Homes, LLC

- Lincoln Property Company

- LMC, a Lennar Company

- Manco Abbott

- Olympus Property

- Simpson Property Group

Tier 2 (1599 or fewer surveys received)

- Carlisle Property Management

- Mack Urban Communities

- Sunrise Management

- Sunrise Management & Consulting

- The Buccini/Pollin Group, Inc.

- TM Realty Services

*Companies are listed in alphabetical order

ELLIS’ SECOND QUARTER 2017 BENCHMARK: QUESTION/TOUCHPOINT RESULTS

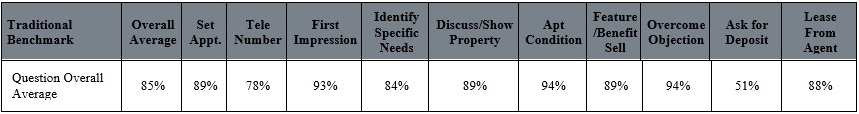

Mystery Shops

How did we do?

The chart below reflects the average Second Quarter 2017 score of Ellis’ entire database of eligible shops1 for each of the 10 key benchmark questions, the Customer Experience by category, and the combined overall Benchmark scores.

Resident Surveys

Line one of the chart below reflects the average scores across all Ellis Resident Survey companies for each survey touchpoint for Second Quarter 2017, and the combined overall loyalty score and average accountability performance results. Line two reflects your company’s scores for comparison (applies to survey customers only).

Millennials: Identifying Missing Pieces in the Workplace- Part II

Millennials are currently driving the biggest transformation in workplace dynamics as they break old tendencies. Unlike previous generations who would spend their entire careers toiling away at the same company, Millennials are job-hopping frequently. As a result, the old stigma toward repeated job movement has been on a steady decline, and companies are beginning to accept the new normal by cultivating Millennials’ talents while they are there. “For Millennials, it is more a matter of career exploration than climbing the traditional ladder. Research suggests that today’s college graduates will have a dozen or more jobs by the time they hit their 30s. In an uncertain job environment, it has become societally and culturally okay that they explore. The expectations have changed. Your 20s are used as the time where you actually figure out what you want to do, so the constant job hopping to explore multiple industries is expected.” – Emily He, CMO of talent management solution Saba.

On the flip side, a recent survey by Qualtrics-Accel Partners of 1,500 Millennials revealed that they would choose to stay in a job for the next 10 years if they knew they would receive annual raises (market value) and upward career mobility. Survey after survey confirms that this generation has a strong need to contribute, develop, and grow in the workplace. According to 36% of those surveyed, if they do not foresee growth opportunities at their current place of employment, they will quickly move on down the road. What are the missing pieces in the workplace that are causing this lack of loyalty? Does the multifamily industry and all of its nuances fit the needs currently presented by Millennials? We conducted our own research and then asked these questions and others to a group of Millennials who were willing to share their thoughts and their own personal experiences at work.

CONTRIBUTION

According to the 2016 report released by the U.S. Bureau of Labor and Statistics, the median tenure (10.1) of those falling in the baby boomer generation was more than 3 times higher than the tenure (2.8) of Millennials. Certainly, the different life seasons and responsibilities are causing some of this divide. However, this brought out a great conversation with our interview group about their need to contribute at work. “I want to be involved. I want to learn the things I don’t know and then apply them. Upward mobility keeps me motivated,” shared one of our interviewees. Yet, some believe that political dynamics in the multifamily industry and others can hinder their ability and future. Lofty goals perceived as premature by some managers are causing friction at work. One of the Millennials we spoke to backed up this notion: “I was willing to learn and be involved with it all! I worked crazy hours, completed extreme amounts of work, and successfully touched all facets of my job. I wanted to be compensated for my accomplishments which were noteworthy, yet others who were there longer and did less outranked me. I was aware of my market value and voiced my concerns. Then I left.” This is not an uncommon story based on our research and conversations.

“Millennials are hungrier and more educated than any generation in history, and they understand technology. They are knocking at the door of people sitting in comfy positions and that’s where the negativity comes from – a real place of insecurity.” – Andrew Challenger, Vice President at Challenger, Gray & Christmas. Baby Boomer and Gen X managers who are willing to put their egos and fears aside and embrace the talent and contributions of this generation are reaping the rewards. In some cases Millennials are revolutionizing industries and companies. Consider some of the most successful Millennials, such as Mark Zuckerberg of Facebook, who create their own business rather than start at the bottom of a large corporation. Traditional companies and leaders look at perks, status, and titles, but Millennials think, “How can I make a contribution to my team, to my department and to my company?”

FEEDBACK AND VALUE

Many Millennials have received adult feedback throughout their earlier years. Their parents have been closely involved in their education, and they have been supported and encouraged at school by teachers and mentors. The contrast can be shocking when they arrive at their first job and suddenly have nobody who is interested in telling them how they are doing – sink or swim. According to a recent survey by TriNet, an HR Solutions organization, 69 percent of Millennials see their company’s feedback and review process as flawed, noting that among other things annual reviews tend to be more focused on reflection than on opportunity. Forbes reports nearly 90 percent would feel more confident if they had ongoing check-ins with their bosses. Putting excellent managers in place to provide continuing performance feedback and to position this young generation for greater success should be the goal. Interestingly, companies such as Deloitte, Accenture, and Gap are abandoning their annual review processes because they have found them to be ineffective at improving employee performance or engagement. Instead career conversations are now a regular occurrence so that managers can help employees stay on track with their ambitions and help them navigate toward their career goals. “We want to be productive. It’s not enough to know that we are valued. We want to know why we are valued. We need regular feedback,” articulated one millennial.

Another fascinating tidbit we gathered from these interviews was that unlike prior generations, Millennials are very aware of their market value because they have access to information their parents did not, and they utilize it! Career sites like Glassdoor.com, Payscale.com, and Salary.com push “know your worth” features on their homepage which calculate market value and plot it on a graph against a current base salary over time. Tools such as these are giving Millennials confidence to frequently interview while they are employed. Receiving ongoing feedback and being paid their true market value, rather than the old annual review and a simple cost of living increase, will increase the engagement. One interviewee stated, “I didn’t buy into the old pay your dues career track, and I was tired of the corporate structure. I chased a more risky job where I would be valued by what I brought to the table versus my age and years of service. It has been worth the risk, and I couldn’t do it without ongoing feedback and great mentors.”

GROWTH

The multifamily industry offers an abundance of opportunities at the onsite level which is appealing to Millennials who are fresh on the job. As leasing professionals, they can transfer from small communities to large ones, experience a variety of product types such as student housing, new construction, senior housing, and affordable housing, and even move across state lines. If their desire is to take on a management role or even a support training role, they can do that, too. Yet the Millennials we spoke with were in agreement that the opportunities beyond the on-ite level are often limited. Those seeking upward mobility through the ranks and a higher paygrade often hit roadblocks. “It is not uncommon for these corporate level positions to be limited to those who have paid their dues with years of service,” shared one millennial. Still another communicated, “A lack of cross-functional departments makes it difficult for an onsite employee who shows an interest in development, investment, accounting, or other regional leadership positions.” Because Millennials want to move up the ranks quickly, one of the fastest ways to do that is to change jobs. If they cannot achieve their goals with your company, they will do it with another. A Gallup study shows that an overwhelming majority of Millennials (93%) say they left their employer to change roles, and only 7% took a new position within the same company. Why would that be the case? A new role often comes with a more elevated title and a substantial pay raise (15% or more versus 1 to 3% by someone staying in their current role). This tendency for Millennials to move out of an organization rather than stick with familiar territory poses significant problems for employers. Targeting talent quickly, fast tracking, and being willing to pay what the market demands could pay big dividends.

Are Millennials all that different from previous generations? Like most of us, they want their contributions to be noticed, feedback to be open and ongoing, and their career development to be nourished and directed. Creating a work environment that encourages all of this and rewards employees based on their true market value will be a place where Millennials not only want to work and stay, but one which they will recommend to their friends and family.

Join us next quarter when we continue to explore our series Millennials: Identifying Missing Pieces in the Workplace.

We thank you for your ongoing participation and feedback, which help make this report informative, fresh, and a reliable resource. We hope you will find Ellis Partners in Management Solutions to be not only the finest source for mystery shopping and resident surveys but also a training resource for your organization. Additional support and information can be found on our website.

July 31, 2017

Prepared by Joanna Ellis, Chief Executive Officer and Francis Chow, Chief Strategic Officer

Footnotes: 1 See Ellis website for Benchmark eligibility, tier level, and recognition requirements for mystery shops and resident surveys. 2 No tier or rank is provided when minimum requirements are not met.