First Quarter 2024 Benchmark Results for Mystery Shops and Resident Surveys

Executive Summary

Welcome to the first of our 2024 Benchmark letter series. The COVID-19 pandemic significantly impacted the apartment leasing market in numerous ways, including the effectiveness of our leasing efforts. Loss of experienced team members and new hire onboardings of short-term employees, accompanied by emerging technologies and post-pandemic growth in new multifamily supply, have all contributed to a noticeable skills gap and decline in closing ratios. This results report discusses noted variances in leasing performance between pre- and post-pandemic and how property managers can successfully drive performance improvements.

As part of Grace Hill, the Ellis and Edge2Learn teams remain focused on product and service integrations, including presenting quarterly benchmarking across the full suite of Ellis and Grace Hill products. This quarter’s article focuses on Ellis Shops and Surveys data for the First Quarter of 2024.

Overall Results

Mystery Shops

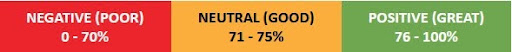

We benchmark apartment mystery shop performance against the 10 key benchmark questions and the customer experience for telephone and onsite presentations. Companies can qualify for platinum, gold, silver, or bronze levels based on their overall quarterly benchmark scores.

For 2023, the average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops was 82%. Performance for First Quarter 2024 rose to 84%. In 2023, the average Ellis Customer Experience Benchmark was 3.7 and remained steady at 3.7 for First Quarter 2024.

Ellis Benchmark Top Performing Mystery Shops by Company – First Quarter 2024

We wish to congratulate the companies below for their Ellis Shopping Benchmark performance for First Quarter 2024.

*Companies are listed in alphabetical order

| Tier 1 (70 or more completed shops) | Tier 2 (30 – 69 completed shops) |

| Ellis Traditional Benchmark Platinum Level Achievers – IMT Residential | |

| Ellis Customer Experience Benchmark Gold Level Achievers** – American Landmark | Ellis Customer Experience Benchmark Gold Level Achievers ** – Continental Properties – Grady Management, Inc – Hanover Company, The – IMT Residential – Morgan Group – TA Realty – Village Green Companies |

Resident Surveys

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Surveys Program. It evaluates performance on five key touchpoints of the prospect and resident journey. The percentage of surveys onsite teams respond to and the average number of days it took for the team to respond are also measured because these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

The overall average Ellis Loyalty Benchmark score in 2023 was 80%. First Quarter 2024 shows marginal improvement to 82%. In 2023, the onsite response rate averaged 82%, dropping slightly to 80% during First Quarter 2024. The average response time in 2023 was 5.7 days, improving to 5.1 days in First Quarter 2024. While onsite teams are responding quicker to surveys, they are responding to fewer. Given the competitive environment for 2024, it is imperative that onsite teams respond to all surveys, even positive ones, to better engage with residents.

The customer loyalty score is based on a scale of 0%-100% (see chart below):

Ellis Benchmark Top Performing Resident Surveys by Company – First Quarter 2024

We wish to congratulate the companies below for their Ellis Surveys Benchmark performance for First Quarter 2024.

*Companies are listed in alphabetical order

| Ellis Best in Class Achievers Tier 1 (1,600 or more units) | Ellis Best in Class Achievers Tier 2 (1,599 or fewer units) |

| – Asset Living – Avanti Residential – Cathcart Property Management – F and F Realty – Fore Property Company – Friedman Realty Group – Guardian Management, LLC – Manco Abbott – Olympus Property – Quarterra – ResideBPG – Russo Property Management – Simpson Property Group – Sparrow Partners – Steadfast Management – Willow Bridge – Woodmont Properties – Zaremba Management Company | – Ghertner & Company – Longboat Enterprises – O’Brien Realty Group – Samuels & Associates – StarPoint Properties – Sunrise Management & Consulting – TM Realty Services – United Financial Group, Inc |

Question/Touchpoint Results: How Did We Do?

Mystery Shops

The charts below reflect the average score of Ellis’ entire database for each of the ten key benchmark questions for telephone/onsite shops for First Quarter 2024, as well as the customer experience for telephone/onsite shops by category for this quarter.

Resident Surveys

The chart below reflects the average scores across all Ellis Resident Survey companies for each survey touch point for First Quarter 2024, as well as the combined overall loyalty score and average accountability performance results.

DRIVING LEASING PERFORMANCE POST-PANDEMIC

Today’s Apartment Leasing Landscape

Today, there is increased demand for larger units with room for home offices, access to high-speed internet service, and outdoor spaces as remote work continues its prevalence. In response, landlords and property managers may need to adjust their marketing strategies, offer incentives such as rent discounts or flexible lease terms, and, where possible, improve property amenities and services. Leasing professionals must address and overcome issues, such as maintenance delays, inadequate property amenities, or poor customer service, which can negatively impact leasing performance related to leases, renewals, and referrals and increase marketing costs.

Rental rates are flexing geographically, falling due to oversupply and reduced demand in mostly urban markets while rising in suburban or rural areas with higher demand. Oversupply can lead to increased vacancy rates and lower rents. Where new developments continue despite reduced demand, leasing professionals face increased competition and may need to work harder to differentiate their properties and attract renters.

However, demand, in general, has been reduced by economic downturns, as many renters choose to extend their current leases instead of making a move. In contrast, some remote workers are considering a shift to more rural living in the absence of a daily commute but are often left with uncertainty surrounding growing ‘return to office’ mandates. According to a recent report from Stanford University, remote work grew 5x between 2019 and 2023, with 40% of U.S.-based employees now working from home. Despite an estimated 10% lower productivity rate by fully remote workers compared to fully in-person workers, the lower cost to employers and heightened desire by workers for a remote environment will continue driving the popularity of remote work.

The landscape of apartment leasing, training, and tools has evolved significantly between 2019 and 2024. Technology advancements, including virtual tours, video consultations, digital access to homes, and sight-unseen lease signings, have become increasingly common, minimizing the human touch points in apartment leasing and forcing teams to find ways to genuinely connect through less personal channels and regain influence over leasing decisions. Insufficient training and resources for, or in some cases access to, these new technologies can hinder leasing professionals’ performance. Tools and a supportive work environment are essential for success in apartment leasing today more than ever.

| Training Methods | Technology & Tools | Focus on Digitization | Compliance Training | |

| 2019 | In-person workshops, seminars, and on-the-job training with experienced leasing professionals that focused on sales techniques, customer service, property management basics, and leasing regulations. | Property management software and CRM systems were commonly used for managing leads, tracking leasing activities, and maintaining tenant records. | Only limited focus and limited digital tools were in place. | Regulatory training, essentially Fair Housing laws and compliance requirements, were standard and delivered through traditional methods. |

| 2024 | It is more diversified and digitized, with virtual training sessions, webinars, e-learning platforms, and video tutorials that allow leasing professionals to access training materials remotely and at their own pace. Topics include digital marketing, virtual leasing strategies, handling online inquiries, and effectively using property management software. | Advanced tools and platforms are standard, including AI-powered chatbots and virtual leasing assistants, data analytics tools with insights into market trends, renter preferences, and leasing performance metrics. Mobile apps and online portals facilitate remote lease signings, rent payments, maintenance requests, and other communication with renters. | Tools and strategies abound to conduct virtual tours, online leasing consultations, and manage leasing transactions remotely. Digital marketing channels such as social media, SEO, and email marketing play a crucial role in reaching potential and existing residents. | It is more comprehensive and accessible through online courses and interactive modules, with real-time updates on regulatory changes. Relevant training on eviction moratoriums, rent control policies, and tenant rights has been added to ensure legal compliance and ethical conduct. |

The shift towards digitalization, remote work capabilities, advanced technology tools, and comprehensive training programs is expected to enhance apartment leasing professionals’ efficiency, effectiveness, and professionalism. Adaptation to these changes is crucial for staying competitive and meeting the evolving needs of residents and property owners in the modern leasing landscape.

Leasing Performance Data Pre- and Post-COVID

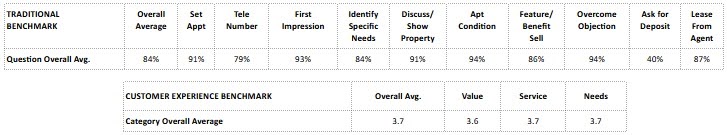

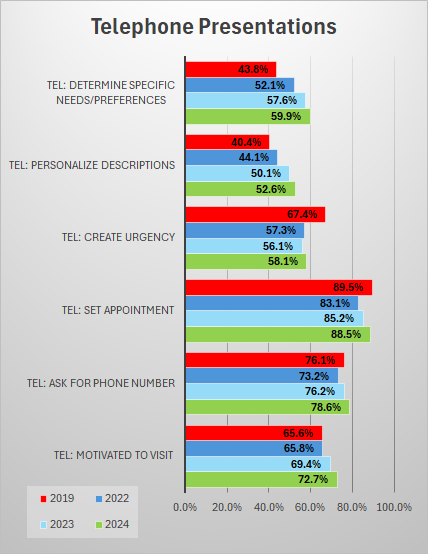

Across a sampling of 130,000 shops conducted by Grace Hill, we identified leasing performance variances between 2019 and 2024 YTD. Some of these variances are more predictable, and others are more surprising.

For telephone presentations, leasing teams are doing a better job determining prospects’ specific needs/preferences and offering personalized presentations, which drives both commitment and desire to visit the property. By contrast, we are less often creating a sense of urgency for the caller to take action. Our data shows the average length of a telephone presentation has increased from 5 minutes in 2019 to 6 minutes today. Since we started tracking that data in 2020, the number of calls to reach a live person has remained steady at an average of 2.

Onsite leasing presentations show few remarkable advancements or declines since 2019. Performance related to selling benefits for the apartment’s features is down by approximately 5%, and while creating urgency onsite has ramped up by over 12%, asking for a financial commitment has fallen by 8%. We are inviting prospects less often (-12%) to return for another look before deciding to lease elsewhere. These markers also drive down a prospect’s desire to lease a home with us.

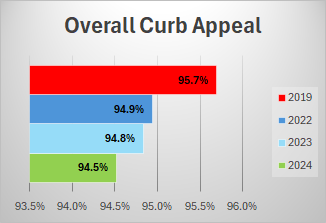

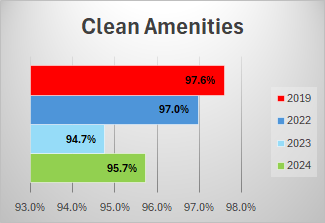

Curb appeal plays a part in prospects choosing to lease, and the data shows some decline there as well, which leasing professionals are left to overcome as part of the process. In 2024, the cleanliness of amenity areas is showing improvement.

|  |

The Roles of Centralization and Personalization in Leasing

With both centralization and personalization playing important but distinct roles in apartment leasing, changes in the leasing and training processes have become requisite for improving and maintaining leasing performance.

Centralization refers to consolidating leasing processes, data, and resources into a centralized system or platform to streamline operations and improve efficiency and consistency across multiple properties or locations. Personalization involves tailoring the leasing experience to meet prospective residents’ individual needs, preferences, and expectations, focusing on building relationships and providing customized solutions to enhance resident satisfaction and retention. Both centralization and personalization aim to improve leasing outcomes. They require effective use of technology, data analytics, and communication tools to achieve their respective goals. However, centralization focuses on operational optimization, standardization, and data management, while personalization emphasizes customer-centricity, relationship-building, and individualized service. Centralization primarily aims to streamline operations and ensure consistency, while personalization aims to create memorable experiences and foster resident loyalty. Balancing both centralization and personalization can lead to a well-rounded and successful leasing strategy, as well as build a strong overall brand presence.

With Centralization:

- Provide tools and support to promote consistency in leasing practices.

- Publish standardized guidelines.

- Offer education that ensures compliance.

- Suggest efficient workflow processes.

- Instruct on best practices to maximize internal resources for managing leads, tracking leasing activities, and maintaining resident records.

- Demonstrate how analysis and reporting will lead to better decision-making and improved leasing performance.

With Personalization:

- Focus on methods and benefits of tailoring the leasing experience to meet the unique needs, preferences, and expectations of prospects.

- Provide customized solutions that build the desire to rent (and stay).

- Reinforce how customer satisfaction fosters stronger relationships and increases conversions, retention, and referrals.

Offering teams a robust online learning platform with access to a wide range of training courses and resources promotes standardized training across multiple properties and teams. Customized training programs with targeted learning paths, soft skills, engagement training, and progress tracking will help ensure personalized skills development and require less training team operational bandwidth. The best choice in training partners will offer centralized training and personalized support to help leasing teams streamline operations, maintain compliance, and deliver personalized experiences that aid in building trust, loyalty, and brand advocacy throughout the leasing journey and beyond.

What should customers expect from us?

- Use of multiple channels to increase online support. Maintain availability on multiple channels, including phone, live chat, email, and even social media.

- More resources for self-service support. Put together a comprehensive knowledge base, FAQs, tutorials, and more to help customers.

- Transparency regarding expected wait/delivery times. This is especially important if your staff is limited. If you require an appointment for tours, make that transparent.

- Feedback loops. Mystery shopping reports and prospect/resident surveys provide actionable feedback and insights for improving lease conversions and renewals.

- Active listening and responses. Use feedback to implement targeted strategies that address pain points and enhance customer engagement.

- Efficient sales processes. Automation and streamlined workflows that reduce manual tasks and eliminate bottlenecks and delays.

- Alignment across teams. A unified approach and identical information regardless of which team member the customer interacts with.

Overall, significant changes and challenges to the apartment leasing market have necessitated the industry to adapt strategies and operations to navigate the evolving landscape. To improve leasing performance, leasing professionals and their organizations must stay updated on market trends, adapt to changing renter preferences, invest in training, provide excellent customer service, and collaborate effectively with their property management teams. Flexibility, creativity, and a proactive approach to addressing challenges can also contribute to better leasing outcomes.

We thank you for your ongoing support, participation, and feedback, which help make this report an informative, fresh, and reliable resource. We hope you find Grace Hill to be not only the finest source for apartment mystery shopping and resident surveys but also a training resource for your organization. Find additional support and information on Ellis – A Grace Hill Company, Grace Hill, and Edge2Learn.

We thank you for your ongoing support, participation, and feedback, which helped make this report an informative, fresh, and reliable resource. We hope you find Ellis | Grace Hill to be not only the finest source for apartment mystery shopping and resident surveys but also a training resource for your organization. Additional support and information can be found on our websites: Ellis – A Grace Hill Company, Grace Hill, and Edge2Learn.

April 30, 2024

Prepared by Lisa Ford, Director Mystery Shopping Services

Ellis – A Grace Hill Company (EPMS)

4545 Fuller Drive | Suite 406

Irving, TX 75038

888.988.3767 telephone

[email protected] | [email protected]

www.epmsonline.com | www.gracehill.com

Footnotes: 1 See website for Mystery Shop Benchmark and Resident Surveys Benchmark eligibility, tier level, and recognition requirements for apartment mystery shops and resident surveys.