Second Quarter 2022 Benchmark Results for Mystery Shops and Resident Surveys Executive Summary

Since 1984, Ellis, Partners in Management Solutions has specialized in helping our customers achieve their business goals. We are pleased to offer a turn-key integrated customer experience program, backed by our outstanding customer service, cutting-edge technology, and longstanding ethical business practices. Our apartment mystery shops, resident surveys, live training, and e-learning and policies and procedures partner (Edge2Learn) are resources that can be used together or independently to address specific needs or jointly for ongoing employee performance optimization. Our goal is to help you achieve yours.

While COVID-19 and its numerous variants have impacted all industries and likely may continue for the near future, the decline in customer service began prior to its arrival. In 2019, Forbes and others reported on the decline in customer service as a result of companies not paying enough attention to providing adequate levels of customer service by phone, online or in person. Recently reported by the Wall Street Journal in the article “Customer Experience is Getting Worse”, staffing shortages and supply chain issues are named likely contributors to a declining quality of customer experience. Pete Jacques, principal analyst at Forrester said, “The changes suggest to us that there are some companies reaching the point where they’re just having a hard time keeping up with these customers’ changing expectations, or are just distracted by all the other things that they need to be focusing on. Consumers who might have been more forgiving earlier in the pandemic are also likely running out of patience. There probably is also an element of, ‘We’ve all been suffering through this through the past few years; we’re now tired of having to wait a long time to get a call answered or a problem resolved’.”

Data already shows that consumers are spending a majority of their income on housing, food, and gas. As prices continue to increase across most industries and a looming recession lies ahead, customers are likely to become more selective and sensitive to how, when, and where they spend money. Could an exceptional customer service experience become the competitive advantage as the rental market becomes more arduous? Let’s face it, even a “reasonable” customer service experience is rare these days. One thing is certain: We must work to understand where customer service opportunities exist and why customer service has declined so rapidly. We need to reframe our thinking on employees and focus our time and attention on both the employee and customer.

ELLIS’ SECOND QUARTER 2022 BENCHMARK: OVERALL RESULTS

Mystery Shops

Ellis benchmarks apartment mystery shop performance on the 10 key Benchmark questions and the Customer Experience. Companies can qualify for platinum, gold, silver, or bronze level based on their company’s overall Benchmark score for the quarter.

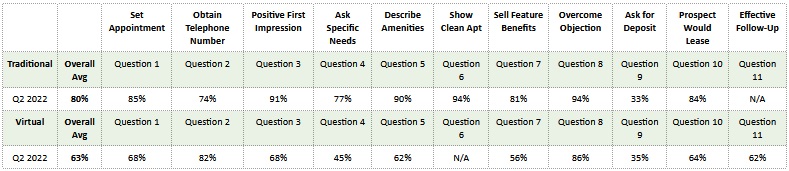

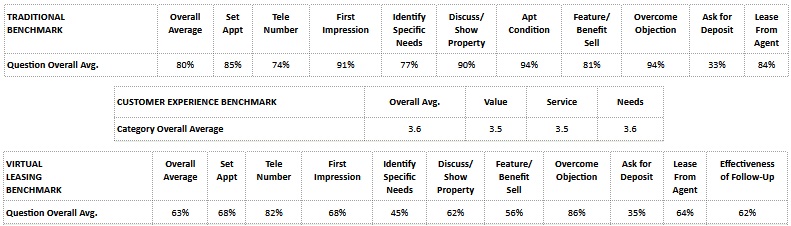

In 2021, the overall average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops1 was 81%. First Quarter 2022 remained steady at 81%, but the average declined to 80% for Second Quarter 2022. In response to industry needs during the pandemic and customer demands, we introduced the Ellis Virtual Leasing Multifamily Industry Benchmark in Q2 2020 based on nearly identical 10 key Benchmark questions. In 2021, the average Ellis Virtual Leasing Multifamily Industry Benchmark score was 64%. In First Quarter 2022, the average Ellis Virtual Leasing Multifamily Industry Benchmark rose to 71%. The Ellis Virtual Leasing Multifamily Industry Benchmark for Second Quarter 2022 reflects a significant decrease to 63%. The Ellis Customer Experience Benchmark score was 3.6 for the Second Quarter 2022, continuing to remain steady over recent years.

As we compare similar questions on Ellis Traditional Multifamily Industry Benchmark to the Ellis Virtual Leasing Multifamily Industry Benchmark scores, we can see the areas which are more consistent in delivery and areas that can be improved.

Mystery Shops Overall Average Performance

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING MYSTERY SHOPPING COMPANIES SECOND QUARTER 2022

Ellis wishes to congratulate the companies below for their Ellis Shopping Benchmark performance for Second Quarter 2022.

Tier 2 (30-69 completed shops)

Ellis Traditional Benchmark – Platinum Level Achievers

- IMT Residential

Ellis Customer Experience Benchmark – Gold Level Achievers

- IMT Residential

- Morgan Group

Companies are listed in alphabetical order

Resident Surveys

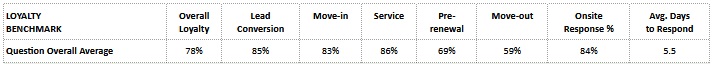

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Surveys Program. It evaluates performance on 5 key touchpoints of the prospect and resident journey. The percentage of surveys responded to by the onsite team and the average number of days it took for the team to respond are also measured because these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies the ability to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

The overall average Ellis Loyalty Benchmark score in 2021 was 76%. This increased promisingly in First Quarter 2022 to 79% but dropped to 78% for Second Quarter 2022. In 2021, the onsite response rate averaged 88%, falling to 87% in First Quarter 2022, and decreasing even further to 84% during Second Quarter 2022. The average response time in 2021 was 5.4 days, improving to 5.0 days in First Quarter 2022 but declining to 5.6 days in Second Quarter 2022

Resident Surveys Overall Average Performance

Ellis’ customer loyalty score is based on a scale of 0%-100% (see chart below):

CONGRATULATIONS TO ELLIS BENCHMARK TOP PERFORMING RESIDENT SURVEYS COMPANIES SECOND QUARTER 2022

Ellis wishes to congratulate the companies below for their Ellis Surveys Benchmark performance for Second Quarter 2022.

| Ellis Best in Class Achievers Tier 1 (1,600 or more units) | Ellis Best in Class Achievers Tier 2 (1,599 or fewer units) |

|---|---|

| · Affinity Property Management · Capstone Real Estate · Cathcart Property Management · F and F Realty · Fore Property Company · FPI Management · Friedman Realty Group · Guardian Management, LLC · Lincoln Property Company · LMC, a Lennar Company · Mack Property Management, LP · Manco Abbott · Olympus Property · Pinnacle (PRMC) · Russo Property Management · Simpson Property Group · Sparrow Partners · Steadfast Management · Woodmont Properties · Zaremba Management Company | · Asset Living · Block Special Assets · Evolve Management Group, LLC · GDC Properties, Inc. · Ghertner & Company · Longboat Enterprises · ResideBPG · Reybold Venture Group · Samuels & Associates · Southern Land COmpany · StarPoint Properties · Sunrise Management & Consulting · TM Realty Services · United Financial Group, Inc. · Woodside Village Management |

Companies are listed in alphabetical order

ELLIS’ SECOND QUARTER 2022 BENCHMARK: QUESTION / TOUCHPOINT RESULTS

Mystery Shops

How did we do?

The charts below reflect the average score of Ellis’ entire database for each of the 10 key benchmark questions and the Customer Experience by category, as well as the combined overall Benchmark scores for Second Quarter 2022. This data provides a roadmap to success, which in most cases means returning to the basics of sales and customer service.

Resident Surveys

How did we do?

The chart below reflects the average scores across all Ellis Resident Survey companies for each survey touch point for Second Quarter 2022, as well as the combined overall loyalty score and average accountability performance results.

RECOVERING FROM THE DECLINING STATE OF CUSTOMER SERVICE

As demonstrated within our letter this quarter, Ellis has seen leasing performance based on recent shopping report results drop in correlation, including declining telephone and virtual tour shop scores, and a decrease in customers being motivated to visit / lease based on these interactions. Here are a few things to consider.

- Do you have the right people? The quality of customer service largely depends on the people, and those who wish to serve the customer. Yes, hiring remains challenging but also what are we doing for existing employees who show up and support us every day? We must be creative in how we entice people to hire and retain employees already on the team. Hint: It is not always about the money.

- Are your employees equipped to manage a continuous changing environment? Agreeably, the leasing process has changed (and continues to do so), especially with the advancement of technology tools and resources designed to enhance the leasing experience. Often, we find a lack of communication, understanding, and process design flaws as more technology is infused into the leasing process. The outcome is not only overwhelming but sends the message of a disjointed and ineffective experience for the leasing professional and the customer. Walk in the shoes of a leasing professional and customer to understand how ongoing changes are impacting these experiences.

- Do team members have the authority and wisdom they need to provide the best service? This is not simply the latest technology and software, which is designed to let you do more with less. This also includes being empowered to make decisions that best serve the customer. Critical thinking skills are key.

- Are your teams suffering from burnout? Many are doing the work of more than one person now. Maybe they are struggling to make ends meet at home while also feeling like they are not accomplishing everything they need to at work. Create an environment that allows employees to speak openly about their challenges, provide educational resources and/or internal programs to support their mental health and well-being. Remember, a well-rounded employee is more engaged, innovative, and high performing.

We have heard it before: If you take care of your employees, they will take care of your customers. Setting clear expectations is vital. Following up regularly to make sure your teams feel heard and supported is essential. And most importantly, lead with empathy. As we all struggle to come to terms with the lasting effects of the Pandemic, we also must rise to overcome the very real state of decline in customer service. Some factors remain out of our control, and it is highly likely the state of customer service will not bounce back overnight. First, take steps to identify your employees’ and customers’ pain points. Then identify the specific ways to improve. And finally – take those first steps and then keep moving in the right direction.

Ellis supports our customers through our vision and commitment to your growing and changing needs. We are here to help you as you work to refine processes and tools for understanding the customer experience from beginning to end. Your Ellis customer dashboard highlights not only Benchmark performance but other key performance indicators (KPIs) and customized reporting is available.

We thank you for your ongoing support, participation, and feedback, which help make this report informative, fresh, and a reliable resource. We hope you will find Ellis Partners in Management Solutions to be not only the finest source for apartment mystery shopping and resident surveys but also a training resource (including our e-learning and policies and procedures partners Edge2Learn) for your organization. Additional support and information can be found on our website. Also, Edge2Learn’s free multifamily training resource library includes several leasing training resources for you and your teams.

August 1, 2022

Prepared by Joanna Ellis, Chief Executive Officer and Francis Chow, Chief Strategic Officer

Footnotes: 1 See Ellis website for Mystery Shop Benchmark and Resident Surveys Benchmark eligibility, tier level, and recognition requirements for apartment mystery shops and resident surveys.