Second Quarter 2023 Benchmark Results for Mystery Shops and Resident Surveys

Executive Summary

As we move into the summer months and peak apartment leasing season, multifamily is seeing continued rent growth across all U.S. markets and classes despite early warning signs of a rough year ahead, slow delivery in the first quarter, and no remarkable changes in vacancy rates. Moody’s Analytics points out that rent growth is settling into pre-pandemic levels. As we continue to navigate 2023 and what it will bring, we discuss in this quarter’s letter the use of artificial Intelligence in apartment leasing and its impact on the multifamily customer experience.

As you may know, Ellis and Edge2Learn were acquired by Grace Hill on November 21, 2022. Our teams remain focused on product and service integrations, including the possibility of presenting quarterly benchmarking across both the Ellis and Grace Hill legacy platforms for shops and surveys. This quarter’s article focuses on Ellis Shops and Surveys data for Second Quarter 2023.

OVERALL RESULTS

Mystery Shops

Ellis benchmarks apartment mystery shop performance against the 10 key benchmark questions and the customer experience for telephone/onsite presentations. Companies can qualify for platinum, gold, silver, or bronze level based on their company’s overall Benchmark scores for the quarter.

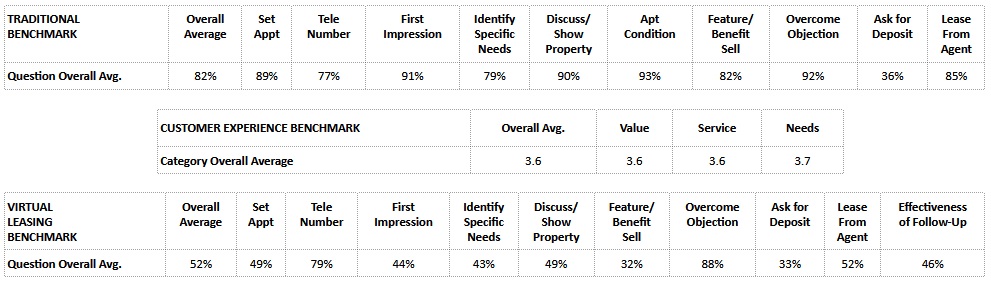

In 2022, the average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops was 83%. First Quarter 2023 remained steady at 83%, and the average dropped to 82% for Second Quarter 2023. In response to industry needs during the pandemic and customer demands, we introduced the Ellis Virtual Leasing Multifamily Industry Benchmark in Second Quarter 2020 based on the nearly identical ten key benchmark questions. In 2022, the average Ellis Virtual Leasing Multifamily Industry Benchmark score was 65%. The average decreased significantly in the First Quarter 2023 to 52%. The Ellis Virtual Leasing Multifamily Industry Benchmark for Second Quarter 2023 was unchanged at 52%. The Ellis Customer Experience Benchmark was 3.6 for Second Quarter 2023, falling slightly from its average of 3.7 across most quarters in recent years.

Ellis Benchmark Top Performing Mystery Shops by Company – Second Quarter 2023

Ellis wishes to congratulate the companies below for their Ellis Shopping Benchmark performance for Second Quarter 2023.

*Companies are listed in alphabetical order

| Tier 1 (70 or more completed shops) | Tier 2 (30 – 69 completed shops) |

| Ellis Traditional Benchmark Platinum Level Achievers – IMT Residential | |

| Ellis Customer Experience Benchmark Gold Level Achievers** – Wood Partners | Ellis Customer Experience Benchmark Gold Level Achievers ** – IMT Residential – Makowsky Ringel Greenberg, LLC – Morgan Group |

Resident Surveys

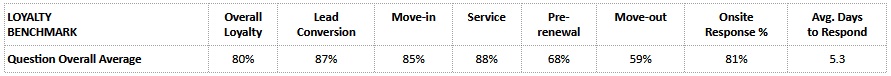

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Surveys Program. It evaluates performance on five key touchpoints of the prospect and resident journey. The percentage of surveys responded to by the onsite team and the average number of days it took for the team to respond are also measured because these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

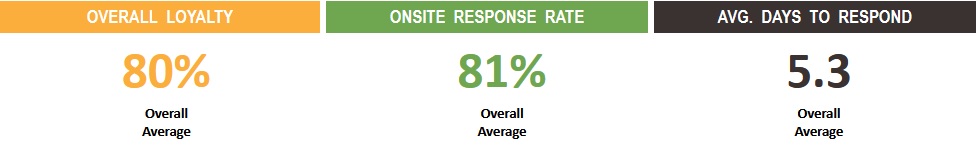

The overall average Ellis Loyalty Benchmark score in 2022 was 78%. First Quarter 2023 reflected a slight uptick to 79% and improved once again to 80% for Second Quarter 2023. In 2022, the onsite response rate averaged 86%, dropping to 82% in First Quarter 2023 and declining further to 81% during Second Quarter 2023. The average response time in 2022 was 5.6 days, improving to 5.2 days in First Quarter 2023 and landing at 5.3 days in Second Quarter 2023.

Ellis’ customer loyalty score is based on a scale of 0%-100% (see chart below):

Ellis Benchmark Top Performing Resident Surveys by Company – Second Quarter 2023

Ellis wishes to congratulate the companies below for their Ellis Surveys Benchmark performance for Second Quarter 2023.

*Companies are listed in alphabetical order

| Ellis Best in Class Achievers Tier 1 (1,600 or more units) | Ellis Best in Class Achievers Tier 2 (1,599 or fewer units) |

| – Affinity Property Management – Cathcart Property Management – F and F Realty – Fore Property Company – FPI Management – Friedman Realty Group – Guardian Management, LLC – Lincoln Property Company – Manco Abbott – Olympus Property – Pinnacle (PRMC) – Quarterra – ResideBPG – Russo Property Management – Simpson Property Group – Sparrow Partners – Steadfast Management – Woodmont Properties – Zaremba Management Company | – Evolve Management Group, LLC – Ghertner & Company – Longboat Enterprises – O’Brien Realty Group – Samuels & Associates – Southern Land Company – Sunrise Management & Consulting – United Financial Group, Inc |

Question/Touchpoint Results: How Did We Do?

Mystery Shops

The charts below reflect the average score of Ellis’ entire database for each of the ten key benchmark questions for telephone/onsite and virtual leasing shops for Second Quarter 2023, as well as the customer experience for telephone/onsite shops by category for this quarter.

Resident Surveys

The charts below reflect the average score of Ellis’ entire database for each of the ten key benchmark questions for telephone/onsite and virtual leasing shops for Second Quarter 2023, as well as the customer experience for telephone/onsite shops by category for this quarter.

Artificial Intelligence (AI) and the Multifamily Customer Experience

The entire world is buzzing about Artificial Intelligence (AI), and no industry more so than multifamily. When we talk about AI, we often include machine learning (ML) as well. ML is essentially a collection of computer algorithms designed to initially perform a task and then become increasingly better at that task as it is repeated. Meaning life is indeed imitating art as AI technology can adapt (hopefully improve) itself over time based solely on its interactions. AI can also be improved with assisted supervision from your team based on opportunities you discover from monitoring the process and results, much like we monitor the effectiveness of human interactions through the leasing process with solutions such as mystery shopping and prospect surveys.

The Use and Impact of AI in Multifamily

In apartment leasing today, AI is most frequently equated to chatbot technology. Chatbots are designed to answer frequently asked questions, schedule tour appointments (both virtual and in-person), and collect vital information about prospective residents for lead follow-up. Chatbots are becoming quite popular, credited with revolutionizing the way our teams interact with prospects and customers. One of the main benefits of chatbots is their availability 24/7, simulating human-like chat, text, and even voice communications, to handle customer inquiries and provide support anytime, generally reducing the need for human intervention.

But as much as we rely on AI to help automate and streamline various repetitive tasks and processes in the multifamily industry, chatbots have their limitations. Despite being equipped to provide a faster response, they can struggle with understanding some questions, especially those that are not part of their predefined script. And, sometimes, your prospect simply prefers speaking to a human. Renting an apartment — finding your new, perfect home — is a personal and sensitive experience. Thus, striking the right balance between automation and human interaction remains a challenge.

Forbes reported in one recent article that AI tools cannot replace human and emotional support, and our use of these tools must supplement, rather than replace, the role of human interaction to create a well-rounded experience. With emotion being one of the highest drivers of decision-making, we cannot rely wholly on AI to achieve an optimal customer experience. Today’s AI still lacks components such as originality and has a limited ability to understand context. AI capabilities must be under constant and continued development to continue serving the multifamily industry. And as its consumers, we must endeavor to measure results and help shape the benefits we expect from this technology.

AI lead nurturing offers convenience and efficiency not just to prospective residents but also to our leasing teams. However, let’s say your AI tool is programmed to automate sending follow-up emails. We cannot assume this is happening, let alone on a defined timeframe. As we’re all too aware, technology can assist us and fail us. Are the follow-ups logged in in our CRM actually making it to the prospect? Are inquiries and responses from prospects being received and properly relayed to our team when human intervention is needed? Are renewal notices queuing at the proper time with relevant and accurate information?

Potential Drawbacks of AI in Multifamily

While our eyes are focused on AI’s promised benefits , including monetary, human resource, and time savings, we must also consider potential drawbacks and ensure we plan appropriately before rushing into an ill-prepared launch. Here are a few things to consider with respect to using AI in property management:

- AI usage and privacy protections are unregulated, requiring us to vet providers more closely and measure outcomes against our own expectations and ethics.

- AI relies on human programming, which can be poorly designed/trained and include unintended biases of the programmer.

- AI can potentially decrease human engagement, closely followed by diminished empathy, social skills, and connections.

- AI can contribute to human skills shortage and greater dependence on technology (i.e., a decrease in critical thinking and problem-solving skills).

- AI may face resistance from prospects and residents who don’t readily embrace new technologies.

Building Rapport and Connection Remains Vital

You may also discover opposition from teams when AI technology is incorporated into your processes. As such, it is important to solicit feedback, embrace questions and concerns, and communicate that AI will never serve as a total replacement for human workers. You could describe it more as a way to enhance, multiply even, employees’ ability to provide excellent customer service. In fact, for the foreseeable future, we will still need human interaction for situations too complex or subtle to be carried out by AI.

Human interaction, as an example, is vital to building rapport, empathizing with prospect/resident concerns, and addressing sensitive issues that require intuition and emotional intelligence. Humans are better equipped to handle discussions related to negotiables like lease terms and other exceptions and can address conflicts and navigate a broad range of issues.

Renters remain skeptical of AI in the wake of continued cybersecurity incidents. Being asked to provide personally identifiable information (PII) via chat, fill out rental applications before being able to take an apartment tour, and more all raise legitimate concerns. How much is too much, and at what point will it cause your prospect to move on to another rental solution?

Harvard Business Review reports that “human conversation remains the primary way people make complex purchases or emotional decisions.” When an AI chatbot fails to understand the underlying emotion of a customer’s response, the reply may come across as insensitive. “Robotic” interactions can lead to frustration and anger, resulting in loss of the customer. No business wants that.

Because the advantages of AI are considered greater than the disadvantages, businesses are quickly acting on this school of thought. According to RT Insights, 50% of businesses aim to spend more on AI this year. According to a survey by Gartner, business use of AI has grown 270% over the past four years. AI technology is not a future trend. It is the here and now. However, we must weigh the pros and cons and make ongoing informed decisions. Bear in mind the discussion surrounding AI is not “to use or not to use” but rather how to develop a plan that enhances the experience for your customer. The best solution is most often the one that gives the customer options. After all, success is due in large part to meeting customers where they are.

Customers are constantly seeking smoother and more satisfying customer experiences. Alongside the product’s value, customer experience remains a key differentiator in who we want to do business with. Recognizing that customers’ lives are increasingly evolving to a digital environment, our job is to find the best ways of providing self-service options, whether through AI or other means, while maintaining personal and authentic connections to build an even better customer journey.

We thank you for your ongoing support, participation, and feedback, which helped make this report an informative, fresh, and reliable resource. We hope you find Ellis | Grace Hill to be not only the finest source for apartment mystery shopping and resident surveys but also a training resource for your organization. Additional support and information can be found on our websites: Ellis – A Grace Hill Company, Grace Hill, and Edge2Learn.

July 31, 2023

Prepared by Lisa Ford, Director Mystery Shopping Services

Ellis – A Grace Hill Company (EPMS)

4545 Fuller Drive | Suite 406

Irving, TX 75038

888.988.3767 telephone

[email protected] | [email protected]

www.epmsonline.com | www.gracehill.com

Footnotes: 1 See Ellis website for Mystery Shop Benchmark and Resident Surveys Benchmark eligibility, tier level, and recognition requirements for apartment mystery shops and resident surveys.